Managing a strata community is complex. Strata managers and owners corporations carry responsibility for the safety, maintenance and wellbeing of entire buildings and the people who live and work in them. With that responsibility comes exposure to risks that can result in significant financial and reputational consequences.

The real cost of disregarding property valuations

You’ve sought professional advice and obtained a valuation. Now the question is, do you take it or leave it? When it comes to determining a Building Sum Insured, disregarding professional advice could be detrimental to everyone concerned: The property owner, the Owners Corporation (OC) Committee and you, the Strata Manager.

Why commercial strata properties require detailed risk information

In today’s insurance market, many insurers are becoming increasingly cautious when it comes to quoting on commercial strata properties. This is particularly true for properties with high-risk tenants or limited risk profile information. Insurers rely heavily on accurate, up-to-date information to assess the risk associated with a property. Without this, many insurers may decline to offer terms or apply significantly higher premiums and excesses.

Understanding the risks of volunteering at your strata property

Being part of a strata community often means pitching in to help things run smoothly. While volunteering your time may feel like a practical way to contribute, it’s important to understand how this affects both your safety and the Owners Corporation’s legal obligations. Here’s what every strata resident, committee member and manager needs to know.

Cladding | The road to rectification

Cladding Safety Victoria was established in 2020 by the Victorian Government and seen as a world-leading initiative via the Cladding Safety Victoria Act 2020 (Vic). The $600 million program was intended to make Victorians safer by helping residential apartment building owners rectify non-compliant or non-conforming external wall cladding products.

Ensuring the right insurance coverage for new strata developments

For developers of new strata properties in Australia, securing comprehensive insurance coverage is a critical step

in the development process. However, common questions often arise, particularly around the need for detailed construction material breakdowns and percentage allocations. In this article, we address some of the most frequently asked queries and explore key considerations when insuring new developments.

Strata insurance market outlook 2025

Looking forward to the new year, there is hope that 2025 will be less turbulent and more predictable than 2024. Reflecting on the past year, we have seen the following trends in the market…

The Strata Insurance Market Explained

Understand the Strata Insurance market landscape and how to achieve the best outcome for strata properties The strata insurance market is always an interesting place. This guide provides you with an insight into the factors that shape the market and a realistic outlook for strata insurance premiums. It delves deeper

Resolute’s Christmas hours & emergency claims assistance 2023

The Resolute team would like to wish you and your family Merry Christmas, happy holiday and hope that you enjoy a wonderful start to the New Year! As we enter the holiday season, we want to notify you that Resolute Property Protect will be observing closure on the public holidays

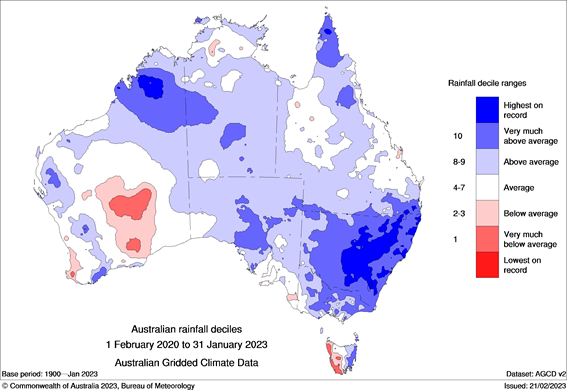

Navigating the Australian Strata Insurance Landscape

Talking about the weather is often an ice breaker before getting on to the real topic of conversation. For insurance, the weather is a big deal, as natural perils like cyclone, storm, and flood, are key components of a premium. The current strata insurance landscape has been shaped by recent